- February 11, 2026

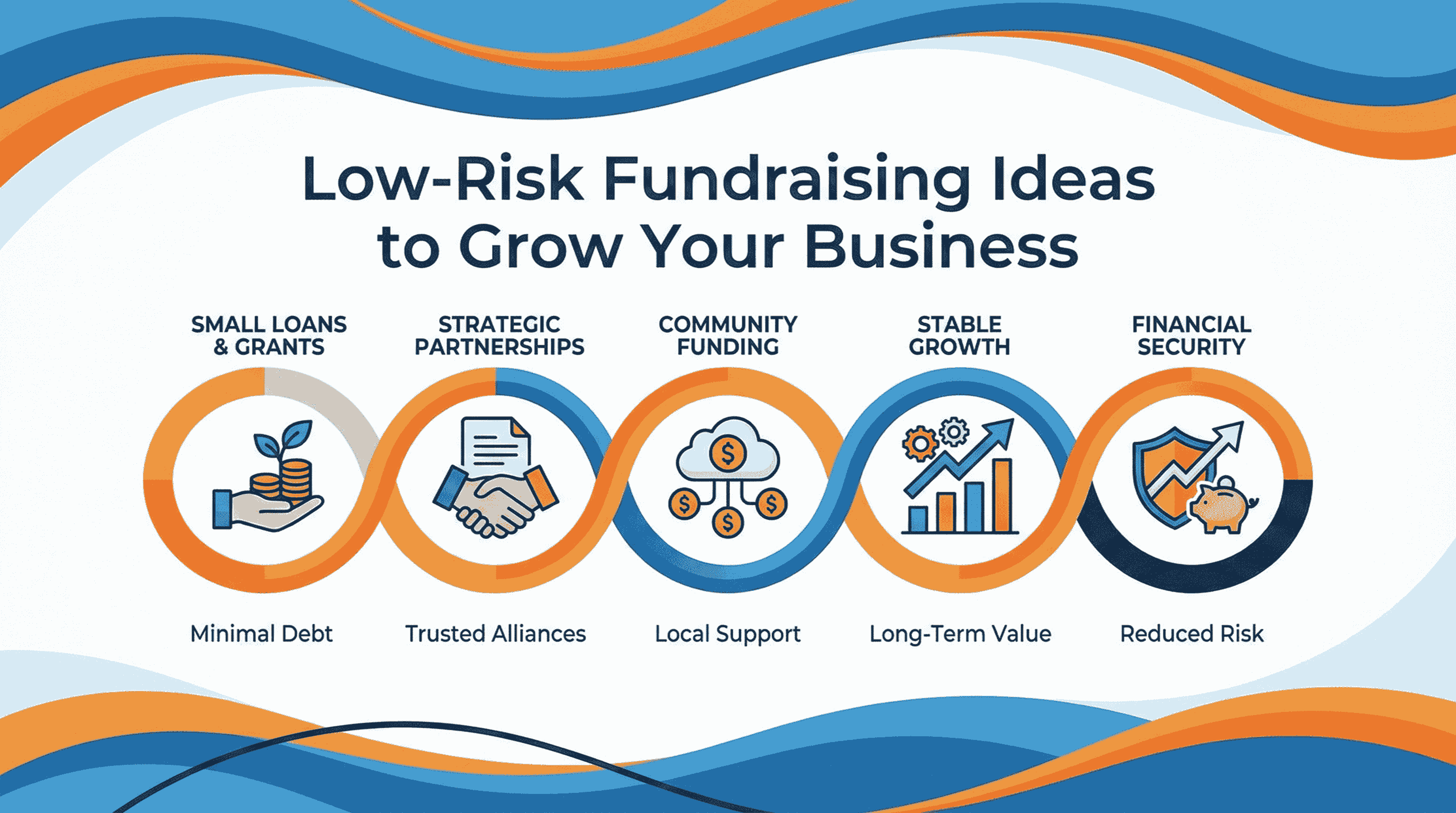

Every entrepreneur understands one simple truth — growth requires capital. But raising money should not mean losing control of your business or taking unnecessary financial risks.

Traditional funding methods often involve heavy debt, strict repayment schedules, or giving up equity. For founders who want sustainable and controlled expansion, low-risk fundraising offers a smarter alternative.

Low-risk fundraising methods focus on:

Limited financial liability

Flexible repayment structures

Customer validation before scaling

Preserving ownership and control

Instead of gambling everything on one funding round, you build momentum step by step.

Bootstrapping means funding your growth using your own revenue and resources. It is the safest and most controlled approach.

Reinvest a fixed percentage of monthly profits

Reduce unnecessary operational costs

Launch minimum viable products (MVP) before scaling

Use existing tools and assets instead of buying new ones

Bootstrapping builds financial discipline and strengthens your business fundamentals.

For businesses generating consistent income, revenue-based models provide growth capital without giving up ownership.

Instead of fixed EMI payments, repayment is tied to a percentage of your monthly revenue. This reduces pressure during slow months.

No equity dilution

Flexible repayment

Growth-focused structure

Founder control remains intact

This model works especially well for digital businesses, SaaS, and online service companies.

Crowdfunding is not just about raising money — it’s about testing your idea in the real market.

Customers pre-order your product before it is officially launched. You only produce once you reach funding goals.

Small investors contribute capital in exchange for minor ownership shares.

Market validation before large investment

Built-in marketing exposure

Community building

Reduced upfront production risk

Crowdfunding combines fundraising with demand validation.

Grants are one of the most powerful low-risk funding options because they:

Do not require repayment

Do not dilute ownership

Support innovation and economic development

Entrepreneurs can apply for:

Innovation-focused grants

Technology development grants

Startup incubation grants

Women or minority entrepreneur grants

Rural development programs

Although competitive, grants provide capital without financial burden.

One of the smartest business growth strategies is getting customers to fund your expansion.

Pre-selling products before launch

Annual subscription discounts

Founding member offers

Advance booking deposits

Milestone-based payment structures

This approach generates working capital while validating real demand.

Small funding options with manageable repayment terms help entrepreneurs scale without heavy financial stress.

These include:

Small business micro-loans

Community development funds

Peer-based lending models

They usually offer:

Lower qualification barriers

Smaller loan sizes

More flexible evaluation criteria

Ideal for early-stage expansion or specific growth initiatives.

When raising money from individuals:

Use formal agreements

Clearly define expectations

Structure investments properly

Maintain transparent communication

Modern funding instruments allow valuation discussions to be delayed until your business grows further.

This protects both founders and early supporters.

Not every funding model fits every business stage.

Grants

Crowdfunding

Early support networks

Customer-funded growth

Micro-funding

Revenue-based models

Strategic investor partnerships

Structured revenue financing

The key is aligning your funding strategy with your business maturity and risk tolerance.

Low risk fundraising ideas to grow your business for schools include events, workshops, donation drives, and pre-sale activities that require minimal upfront cost and low financial risk.

Quirky fundraising ideas for schools include theme days, creative challenges, student-led activities, and fun competitions that engage participants while raising funds creatively.

Cheap fundraising ideas focus on low-cost activities like community events, digital campaigns, or skill-based fundraisers that rely more on participation than spending money.

Easy fundraising ideas for small groups include small events, collection drives, online challenges, and service-based fundraisers that are simple to organize and manage.

Fundraising ideas for charity UK often include local events, awareness campaigns, donation initiatives, and community-focused activities designed to raise funds ethically and responsibly.

Smart entrepreneurs understand that raising capital should strengthen the business — not weaken ownership or create long-term pressure.

Low-risk fundraising allows you to:

Maintain decision-making authority

Protect personal assets

Validate ideas before scaling

Build sustainable growth

The right funding strategy is not about raising the most money — it’s about raising the right money at the right time.